Blade's Benchmark: No Impermanent Loss

Blade's pools act like a daily rebalancing portfolio composed of roughly 1/3 ETH, 1/3 WBTC, and 1/3 stablecoins (with zero transaction costs for rebalancing). This rebalancing strategy results in no impermanent loss for LPs.

How Blade Stacks Up Against the Benchmark

Blade's benchmark is no impermanent loss. It achieves this through tracking a theoretical costless DRP.

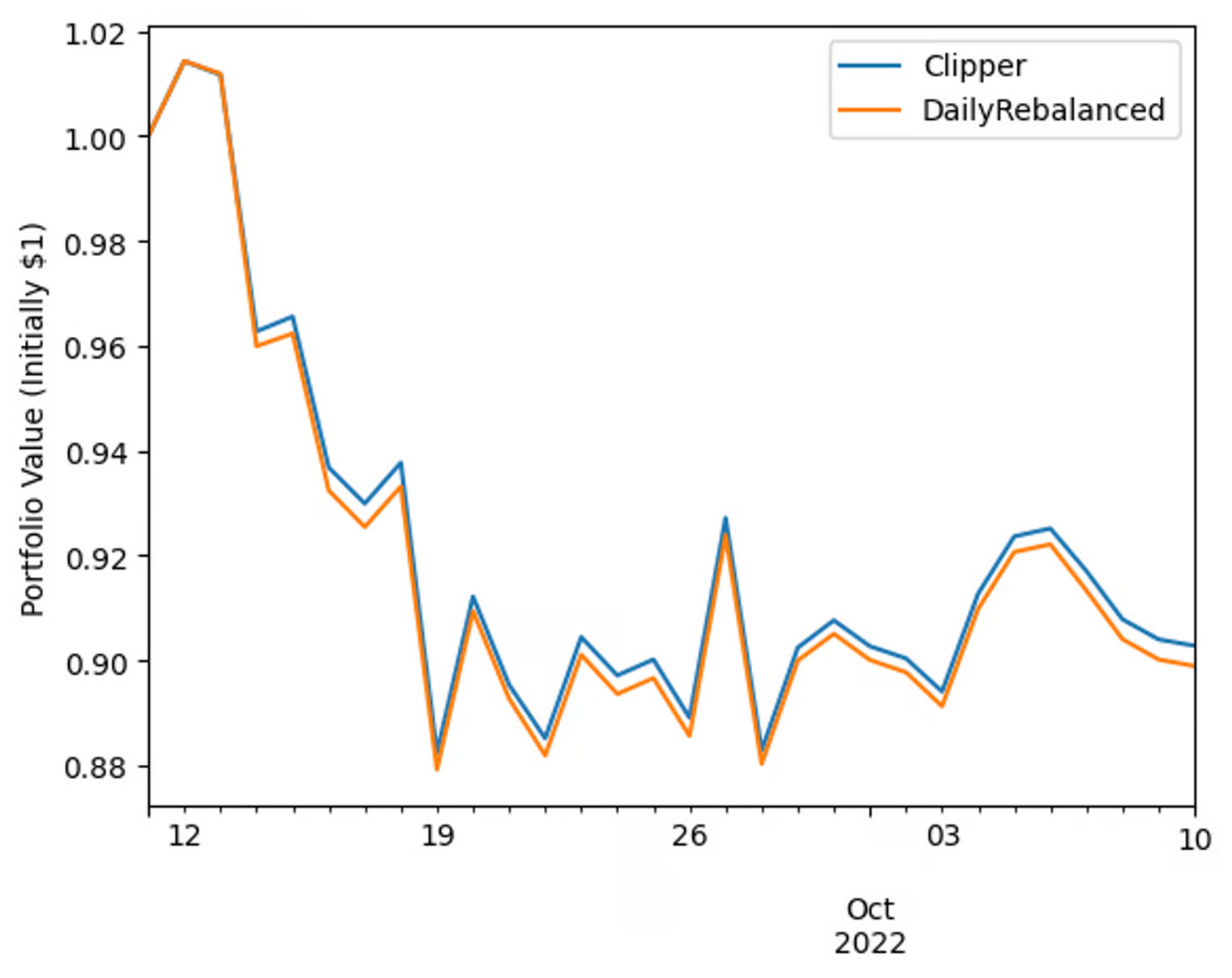

If we look at a sample of Blade's performance from September 11, 2022 through October 10, 2022, we see that it closely tracks the DRP while staying slightly ahead of it--finishing the interval almost 40 basis points ahead.

Note: Blade is "Clipper" in the chart below; Clipper was the initial name of Blade

Blade was within 1 bps of the DRP for more than three-quarters of the days in the period. For those days where Blade and the DRP diverged by more than 1 bps, Blade was in the leading position more than two-thirds of the time (23% vs. 10% of days).

| Blade LP Daily Performance vs. Benchmark | Frequency |

|---|---|

| > 1 basis point worse | 10% |

| 1 basis point worse to 1 basis point better | 77% |

| > 1 basis point better | 23% |

The reason for return divergence is that Blade's FMM will make trades continuously with traders over the course of a day, while the theoretical DRP is simulated to costlessly rebalance once per day. Despite the divergences, the daily correlation of percent returns to the returns of the DRP was extremely high at ρ = 0.9996.

Blade's close tracking of the DRP is what enables it to hit its no impermanent loss benchmark.